test-server2.sennett.co.uk | Bridging Loans

695

page-template-default,page,page-id-695,ajax_updown_fade,page_not_loaded,

-

Bridging LoansBridging has been a boom market and is getting very competitive but often there are transactions that don’t work for traditional bridging lenders. Bridge-IT's highly experienced team really gets bridging, giving fast approval on many cases and with very competitive rates from just 0.75% pm on lower LTV transactions.OVER £500M READY TO LENDFAST, FLEXIBLE FINANCESECOND CHARGES CONSIDEREDDECISIONS WITHIN 1 BUSINESS DAYNATIONWIDE TEAM

Bridging LoansBridging has been a boom market and is getting very competitive but often there are transactions that don’t work for traditional bridging lenders. Bridge-IT's highly experienced team really gets bridging, giving fast approval on many cases and with very competitive rates from just 0.75% pm on lower LTV transactions.OVER £500M READY TO LENDFAST, FLEXIBLE FINANCESECOND CHARGES CONSIDEREDDECISIONS WITHIN 1 BUSINESS DAYNATIONWIDE TEAM

LOW INTEREST RATES• 70% LTV based on 90 day valuation

• Borrowing from £200k-£7m +

• Funds available for fast turn around across U.K., Europe and Worldwide of residential/commercial real estate

• 48 hours-Indicative terms- based on receipt of information by borrower• Generally loan security dependant on first legal charge on potential development site or other securities maybe required dependant on risk.

• Linked pricing varies due to risk, location and borrower status

• Prefer planning permissions granted prior to lending

• Regular communication with borrower during bridge periodHow you'll Benefit

-

BenefitsFirst and Second Charge LoansSubject to rate adjustment on higher Second Charge LTVsSecond Charges consideredWe don’t just lend on First ChargesWhole of mainland UK consideredNot just the South East and the M25Impaired Credit Applications consideredwith a 'good story' that we can verifyConvert to Development FinanceBeing development finance specialists as well, once your site is development ready we offer conversion to development finance with monthly drawdownsBroker/Introducer fees paidOnly pay for what you have toIntroducer Benefits

BenefitsFirst and Second Charge LoansSubject to rate adjustment on higher Second Charge LTVsSecond Charges consideredWe don’t just lend on First ChargesWhole of mainland UK consideredNot just the South East and the M25Impaired Credit Applications consideredwith a 'good story' that we can verifyConvert to Development FinanceBeing development finance specialists as well, once your site is development ready we offer conversion to development finance with monthly drawdownsBroker/Introducer fees paidOnly pay for what you have toIntroducer Benefits

-

Introducer BenefitsLong Term Partnership and SupportA dedicated Relationship Director will work with you to maximise your understanding of our great range of flexible finance productsExcellent, professional CollateralWe can supply mailers, term sheets and case studies ready to send out to your clients, co-branded if required. Create and manage tv, press, radio and social campaignsRewardingWe pay procuration fees to introducers where this does not create a conflict of interestWide range of Finance solutionsOne relationship, lots of products to suit different requirementsWant to see the Terms?

Introducer BenefitsLong Term Partnership and SupportA dedicated Relationship Director will work with you to maximise your understanding of our great range of flexible finance productsExcellent, professional CollateralWe can supply mailers, term sheets and case studies ready to send out to your clients, co-branded if required. Create and manage tv, press, radio and social campaignsRewardingWe pay procuration fees to introducers where this does not create a conflict of interestWide range of Finance solutionsOne relationship, lots of products to suit different requirementsWant to see the Terms?

-

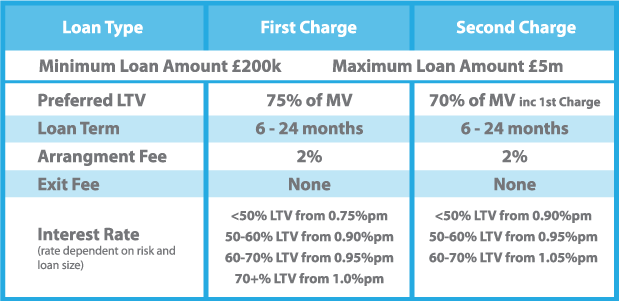

Each facility will be structured and priced on its own merits.We will consider terms outside the above LTV and maximum loan guidelines where the circumstances of the loan warrant it.

Each facility will be structured and priced on its own merits.We will consider terms outside the above LTV and maximum loan guidelines where the circumstances of the loan warrant it.

Bridge-IT is happy to pay procuration fees to Introducers provided it does not create a conflict of interest.

Indicative Terms correct as of 1st Oct 2016Security

• First or second charge security taken over acceptable properties in mainland UK

• Where the borrower is a Limited Company, additional security will be required in the form of a debenture over the company, a charge over the shares of the borrower and Personal Guarantees from all Directors/Shareholders

• Deed of Priority required from existing lender on Second Charge loansLending Terms

• Interest charged daily subject to minimum loan term (specific to each loan)

• Retained interest preferred, however, we will consider allowing interest to be serviced by the Borrower, subject to affordability

• We will lend to an individual or Limited Company (including SPVs) and are able to consider overseas jurisdictions owning UK properties, subject to suitable foreign legal opinions

• Broker fees will be added to the loan where the LTV allows and paid on completion. Responsibility for advising the Borrower on structure and pricing will be solely that of the broker

• Details of a viable exit will be required and in some cases we may request evidence of this

• Lending will be based on the market value (180 day), however, we reserve the right to lend based on the 90 day value should we deem it necessary

• Where a property is being purchased at a discount, we will lend up to 95% of the discounted purchase price as long as this does not exceed the maximum LTV for the scheme

• Impaired credit will be considered on a case by case basis

• The borrower is responsible for all professional fees and an undertaking/cover for legal and other professional costs will be required

• Title Insurance will be a requirement on loans where they t the relevant criteria and the fee for this will be included in the legal cost

• Commercial properties considered

• Please note: Bridge-IT does not provide FCA regulated mortgage contracts or regulated Consumer Credit loansSee a Case Study

-

Case StudyNottinghamProject GDV: £1.5 million

Case StudyNottinghamProject GDV: £1.5 million

Number of investors: 118

Tajinder Ubhi, owner of Trent Pads used the Bridge-IT peer-to-peer lending platform to borrow £1.5m to fund the build of a student accommodation block in Nottingham, borrowing from 118 investors who lent between £10 and £350k.

Bridge-IT’s peer-to-peer platform allows individual investors to join together and lend as much or as little as they would like directly to UK SMEs and property businesses such as Trent Pads.

With planning permission already in place, the loan Tajinder received from our investors was used to build the 4 storey, 46 bed student accommodation development called Six Degrees on time. Working with the best contractors and advisors to complete this successful build.“The banks weren’t helpful so I was forced to look for another way to nance the deal. The Bridge-IT team were fantastic and I have absolute belief in what they are developing, so it was great to see every aspect of this nance deal come o to perfection. I will de nitely seek funding through peer-to-peer for future developments.”

-

Case StudyNottinghamProject GDV: £1.5 million

Case StudyNottinghamProject GDV: £1.5 million

Number of investors: 118

Tajinder Ubhi, owner of Trent Pads used the Bridge-IT peer-to-peer lending platform to borrow £1.5m to fund the build of a student accommodation block in Nottingham, borrowing from 118 investors who lent between £10 and £350k.

Bridge-IT’s peer-to-peer platform allows individual investors to join together and lend as much or as little as they would like directly to UK SMEs and property businesses such as Trent Pads.

With planning permission already in place, the loan Tajinder received from our investors was used to build the 4 storey, 46 bed student accommodation development called Six Degrees on time. Working with the best contractors and advisors to complete this successful build.“The banks weren’t helpful so I was forced to look for another way to nance the deal. The Bridge-IT team were fantastic and I have absolute belief in what they are developing, so it was great to see every aspect of this nance deal come o to perfection. I will de nitely seek funding through peer-to-peer for future developments.”